How Much Does It Cost To Max Champion Gear

Video How much does it cost to max champion gearThis is our advised Gear Overview in Lords Mobile. We’re sure not every one of the information is totally precise. We’re sure IGG employee/apologist will certainly refute this by stating “The game data says that the blood sucker drop rate is 10% not 5%, your guide is completely false. You can make all of the crappy move speed gear you want”. Numbers ought to be taken as a price quote. We desire to give a close estimation, as opposed to some exploitive response like: “Oh you can buy the $5 pack and get really lucky and get your Ambrosial Cups for $5. Go buy more packs” or “Monsters drop materials too! Go hit monsters if you want gear.” If you’re brand-new to the video game or a sophisticated gamer, you ought to inspect our various other Lords Mobile Guides in the Guide-Section.New: Lords Mobile Shopping Mall Load Worth EvaluationReading: How much does it cost to max champion gear

Basics of Tools

Contents

- IGG on a regular basis nerfs the decrease price of crucial products in Lords Mobile. So expenses are responsible to increase. If you ask them about it they will give some kind of explotive answer like “oh you’re just unlucky, go open more boxes.”

- Everything is temporary and reflects the current state of the game. If IGG increases the level cap, every gear is going to be almost worthless.

- Research, Construction and Training Speed contributions are determined when you start the research/construction/training. You can switch out of the gear right afterwards and the timers will be the same.

- Move speed is determined by two checks, when you hit go, and when your troops set off. For non-rallies these two events occur at the same time. Generally in pvp situations you do not want to be swapping move speed gear as the risk of forgetting something and not being 100% your strongest is a bigger deal than a little saved moved speed.

- Capacity is determined by two checks, when you set off, and when you hit the tile/player.

- Gathering speed is determined by when you hit the tile. We do not know if there is a check if you set off.

- Combat is determined by 1 check, when you hit the enemy. So you always can swap gear/talents/boosts mid march.

Thus you will want to have gear sets for all sorts of different situations and swap them in and out based on what you are doing at the moment. Quick swap is worth it. Your profile is saved even if you upgrade the grade of your equipmentIn general people talk about F2P equipment and P2P equipment in Lords Mobile. The dividing line between F2P equipment and P2P equipment is the ultra rare material. Ultra rare materials have an extraordinarily low drop rate from monsters, as well as a low drop rate from boxes. The only feasible way to get ultra rare materials at a reasonable rate is via packs. Any drops aside from the ultra rare materials are essentially worthless. You will almost always have more than enough non-ultra rare materials. So that legendary frostwing claw? Yeah, you’re going to have dozens by the time you have enough legendary frostwing hearts.That being said, every event monster has a F2P variant of the equipment that does not use ultra rare materials, F2P gear generally has a lvl 40-45 level requirement, and is crap compared to the lvl 60 versions of gear. Any gear you can gather is considered F2P. We believe that there is a correct troop type you need to gather with to increase rare material drops. Stone = Infantry, Wood = Ranged, Ore = Cav, Food = Siege. We haven’t extensively tested it, but we have done enough gathering to convince us of it.

Regular Gear Sets that everyone should own

1) Player Experience Player Experience gear comes from the $50-$100-$100 a winning start (Big Guy) Packs in Lords Mobile. The only other sources of player experience boosts are VIP9 and 25% turf boost. We don’t feel like turf boost is worth it, but it is a decent guild fest reward choice. Swap into your Player Experience gear when doing anything that generates experience, turf quests, hero stages, arena, admin/guild quests, and farming kills.2) Gathering Speed / Looting A lot of the gathering speed and army capacity gear overlaps with the construction and research gear, (noceros and gryphon gear gives good amounts of gathering speed and army capacity)Army Capacity is very important, it increases the amount of loot your troops can hold. So when looting, put on your Army Capacity and Move Speed to loot faster.Move Speed is useful too, switch to move speed gear in Lords Mobile when supplying rss.3) Research and Construction You will want 3 Gold Lunar Flutes and 3 Gold Sentinel Circlets asap. Two if you are not C25 yet (see advanced guide for why delaying C25 is a good choice) Other F2P research gear use materials you need for your Lunar Flutes and Sentinel Circlets. It is okay to have them 1 grade lower than your lowest lunar flutes, like make the calvary mail blue after you get 3 purple lunar flutes.In addition there are the Noceroes and Gryphon gear. There is a $50 castle level pack that includes a lot of boxes (C21?), and many of the packs you buy include Noceroes and Gryphon boxes.The ultra rares are lightning vials and gryphon cores in Lords Mobile. There is a labyrinth monster (terrorthorn) that has a good droprate of these so save your holy stars if you are low budget. There is also a $5 pack that gives 10 lightning vials, 10 gryphon cores and well as 20 of each box, but you can skip this. In addition if you are buying material madness for combat gear, the monstrous chests include lightning vials and gryphon cores.4) Monster hunter gear We do not think investing heavily in monster hunter gear is worth it in Lords Mobile. Maybe a couple of $5 packs max. Doing higher damage does not improve drops. We talk about it a little more in the general guide. Using move speed gear is a close approximationRead more: how to put a filter in a pipe5) Hyperfarm gear (optional) Generally you’re going to want to focus your account on one resource, so you might as well get gear that is good for that resource. This should be the last priority.

You should also check this Lords Mobile gear guide by Llama King:

Getting Combat Gear

The best way to get Combat Gear in Lords Mobile is from the $20 material madness pack. Note, if people start buying the material madness pack and less of the individual monster packs, IGG will nerf the material madness pack. So this advice is responsible to be changed in the future.

- We believe the rarity distribution for non-champion material packs are close to 0.25% legendary, 1.25% epic, 5% rare, 13.5% uncommon, 80% common. Different monster packs have different drop rates for ultra rare materials. In general we noticed The Mecha Trojan, Saberfang, Queen Bee, Hell Drider, Grim Reaper, Maggot, Wyrm, Queen Bee, Frostwing, Blackwing, Noceros, Gryphon are all ‘Easy Chests’. They have regarding 5% ultra rare drop rate. Including rarity, this works out to be an average of 12.8 white ultra rares per 100 chests

- Hard Chests for us have been Titan Titan and Bon Appetit. They had about a 2.5% ultra rare drop rate. Including rarity, this works out to be a 6.4 white ultra rares per 100 chests.

- We don’t have much data on Terrorthorn, we seemed to have a low drop rate on those chests. But since we don’t need any Terrorthorn gear we didn’t open much of those chests.

Unverified stuff – We believe champion gear has a high legendary/epic drop rate, but a very low crimson maine drop rate. Overall we believe you are much more likely to get a legendary crimson mane than say a legendary blood sucker, even though saberfang is an ‘easy pack’. This is designed to get people to think “oh i’m so lucky, we got a legendary crimson mane, time to buy 50 more champion packs.” However it will certainly make getting a small amount of champion packs a huge gamble as the vast majority of the Crimson manes you need for gear from boxes will come from opening Epic/Legendary ones.

- We believe legendary jewel chests have a better rarity distribution than material chests.

- We believe for monstrous chests, the materials have different weights. Blood Suckers/Jade Orbs seem to be the most common, while Glowing Halos/Mutated Brains/Ancient Blueprints have a lower drop rate.

The $20 material madness pack in Lords Mobile is the best way to get gear in the game. It comes with 20 monstrous chests and 1000 monster boxes. After the $20 material madness, it’s the $50 and $100 (They don’t lose that much value going up). Then the $5 individual monster packs. Be on the lookout for monstrous chests, some other event packs include them. If you can get 5 monstrous chest + goodies for $5, we feel like that is a decent deal.

Pre Level 60 combat gear in Lords Mobile

The purpose of gear is to make you stronger in Lords Mobile. If your pre 60, you probably don’t have T4 yet. The best way to get stronger is by working on the military research tree.All of the pre-60 gear gets very outclassed by the post 60 gear. We would not waste ultra rares on pre-60 gear sets. Why spend a ton of ultra rares on getting 2% more attack when you haven’t even finished Army Offense 9? Get your research done first.Post T4 the calculation changes as additional improvements via research take a very long time/investment. But by then you are either 60, or close enough that you shouldn’t use ultra rares either.Do not use gathered combat gear like Fiery Tomahawk or Lost Island Relic in Lords Mobile. They use materials you need for your lunar flutes and sentinel circlets. Once you have 3 gold lunar flutes and 3 gold sentinel circlets, you can consider making them if you still would like them.Pre-60 Gear (Non-Ultra rare gear): Weapon: Big Guy Sword (Other choices use ultra rares/lunar flute mats) Offhand: Frostwing Shield Helm: Bon Appeti Helm Chest: Hell Drider Chest Boots: Queen Bee Boots Accessories: Aqua Anemone, Saberfang Accessory (only accessory with move speed, this will be a part of any looting gear set)Of note: Burning scrolls are a good budget choice for accessories. If you are planning on going the Frostwing greatsword + Burning Scrolls route you can start equipping the Burning Scrolls early.

Level 60 Gear in Lords Mobile

Choosing the Correct Troop type is the most important part of attacking in lord’s mobile, it’s like a 3x advantage getting the Troop type correct. Even if you have the best full infantry gear in the game you are better off using ranged with no gear against cav than infantry with amazing gear.In addition material madness lowers the cost of gear and balances out your material across many different important monsters. So making a mixed set is cheaper than say a helldrider only set.Thus you want to focus on a balanced gearset first, and then go for more troop specific ones.Reference This sheet for Cost Comparisons of viable lvl 60 gold gear choices: topqa.info/iyUQkmH This sheet makes a lot of assumptions, but it provides a good rough approximation on the choices available. The weight is heavily geared towards attack. We believe the more troops you kill, the easier your follow up hits are. So attack is by far the most important stat.Read more: How to Clean & Care for Outdoor Porcelain TilesUltimately the lvl 60 gear choices involve how much stats you are willing to provide up in exchange for cheaper gear.

Jewels

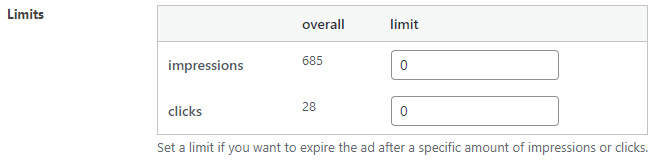

Jewels are incredibly important in Lords Mobile. Getting 8×3 Rare troop attack Jewels is going to give you a ton of stats. Upgrading them to Epic and legendary are going to give you a ton more. The best way to buy Jewels is the $100 Jewels pack. The $100 Jewels pack is better than 5x $20 pack. So there is no point in buying the $20 each month. Either you save your money and buy $170 in one go. Or you just skip the pack entirely.We only bought the Jewel Pack to $170 once, and from it we got enough jewels to make 1.5 epics of each type of attack jewels. We believe this is bad luck, and in general you should expect 2 epics of each type of attack jewel after paying $170.

Champion Gear

Champion Gear in Lords Mobile costs about $50k for full gold. Monster gear will almost always outclass champion gear in terms of $ spent per stats gained. Champion only starts beating Monster Gear once you take it to gold.

More Lords Mobile Guides

This Lords Mobile Gear Guide by ‘Lets Rebuild’ is also not bad:If there is anything you are missing in this Gear Guide for Lords Mobile, do not be afraid to let us know! You can tell us here in the comments and we’ll add it asap. For more Lords Mobile Guides, check out our guide-section and if you are new to the video game, the Beginners Overview.Read more: How to play fast solos on guitar

Last, Wallx.net sent you details about the topic “How Much Does It Cost To Max Champion Gear❤️️”.Hope with useful information that the article “How Much Does It Cost To Max Champion Gear” It will help readers to be more interested in “How Much Does It Cost To Max Champion Gear [ ❤️️❤️️ ]”.

Posts “How Much Does It Cost To Max Champion Gear” posted by on 2022-04-22 19:30:24. Thank you for reading the article at wallx.net