How To Set Up Restricted Funds In Quickbooks

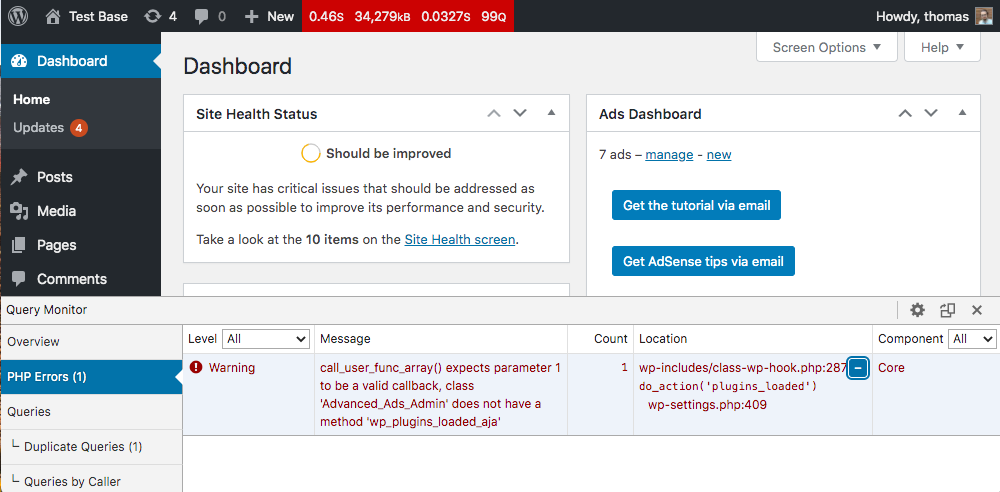

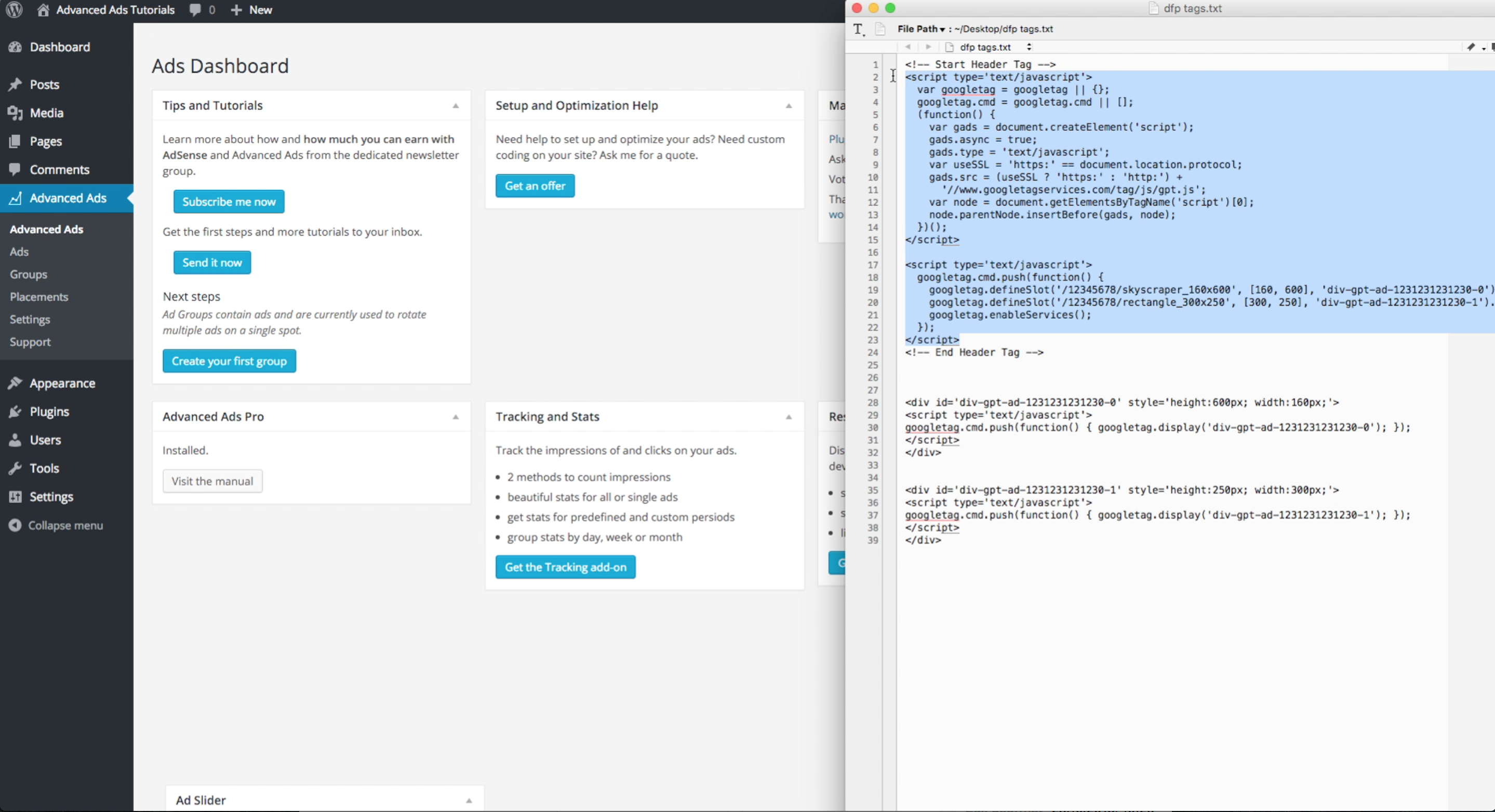

In this article, follow the steps mentioned in “set up limited funds in QuickBooks“. One of the main points of confusion in nonprofits is how to record restricted contributions. Under accounting rules, restricted contributions must be recorded during the life when the funds are promised, even if they are received over a future period. Creating a prosthetic nose ring Although QuickBooks does not provide a direct opportunity to monitor restricted funds, it is possible to do so by using classes and allocating all restricted funds to a class . Then, when the report is run, you can choose a specific class filter to return only the restricted amounts in your registry. Note: All non-discretionary funds should be created with a separate limited fund type.

Why do you need to set up a limited fund in QuickBooks?

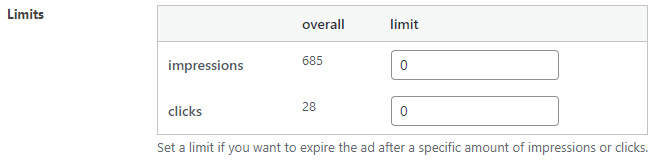

The limited fund is used as a reserve account where funds are stored for specific purposes and uses. Furthermore, the limited fund promises to assure donors that the donations provided by them are used in the way they have chosen. be bound to spend in a particular way or for a particular reason as mentioned in the service contract or sponsorship offer, or as expressly stated by the sponsor or sponsor.

To set up a limited fund in QuickBooks:

I hope the information provided above will be of help to you if you are unable to set up restrictions in QuickBooks, your query with QuickBooks assistance. Read more: how to keep the mulch off the sidewalk

Frequently asked questions

Last, Wallx.net sent you details about the topic “How To Set Up Restricted Funds In Quickbooks❤️️”.Hope with useful information that the article “How To Set Up Restricted Funds In Quickbooks” It will help readers to be more interested in “How To Set Up Restricted Funds In Quickbooks [ ❤️️❤️️ ]”.

Posts “How To Set Up Restricted Funds In Quickbooks” posted by on 2021-11-04 19:13:20. Thank you for reading the article at wallx.net